Unknown Facts About Eb5 Immigrant Investor Program

Unknown Facts About Eb5 Immigrant Investor Program

Blog Article

Some Known Questions About Eb5 Immigrant Investor Program.

Table of ContentsThe Greatest Guide To Eb5 Immigrant Investor ProgramA Biased View of Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program - An OverviewGetting The Eb5 Immigrant Investor Program To WorkEb5 Immigrant Investor Program for BeginnersEb5 Immigrant Investor Program - Truths

In spite of being less popular, other paths to getting a Portugal Golden Visa include financial investments in endeavor funding or exclusive equity funds, existing or new service entities, funding transfers, and donations to support clinical, technological, creative and social growths. Owners of a Portuguese resident license can additionally work and examine in the nation without the need of obtaining extra authorizations.

Unknown Facts About Eb5 Immigrant Investor Program

Investors should have both an effective entrepreneurial background and a considerable service record in order to apply. They may include their partner and their youngsters under 21-years- old on their application for irreversible residence. Effective applicants will certainly get an eco-friendly five-year reentry license, which enables open travel in and out of Singapore.

Unknown Facts About Eb5 Immigrant Investor Program

Applicants can invest $400,000 in federal government accepted genuine estate that is resalable after 5 years. Or they can spend $200,000 in government approved real estate that is resalable after 7 years.

This is the main advantage of arriving to Switzerland contrasted to other high tax obligation countries. In order to be eligible for the program, candidates have to Be over the age of 18 Not be used or occupied in Switzerland Not have Swiss citizenship, it must be their very first time staying in Switzerland Have rented out or bought home in Switzerland Supply a long listing of recognition documents, consisting of tidy criminal record and great moral character It takes around after payment to acquire a resident permit.

Rate 1 visa more info holders stay in standing for about three years (depending upon where the application was submitted) and should relate to extend their stay if they wish to proceed staying in the UK - EB5 Immigrant Investor Program. Prospects must have individual properties that worth at greater than 2 million and have 1 million of their own cash in the U.K

Get This Report on Eb5 Immigrant Investor Program

The Rate 1 (Entrepreneur) Visa stands for three years and 4 months, with the option to prolong the visa for one more 2 years. The candidate may bring their dependent member of the family. As soon as the entrepreneur has actually been in the United Kingdom for 5 years, they can apply for uncertain delegate continue to be.

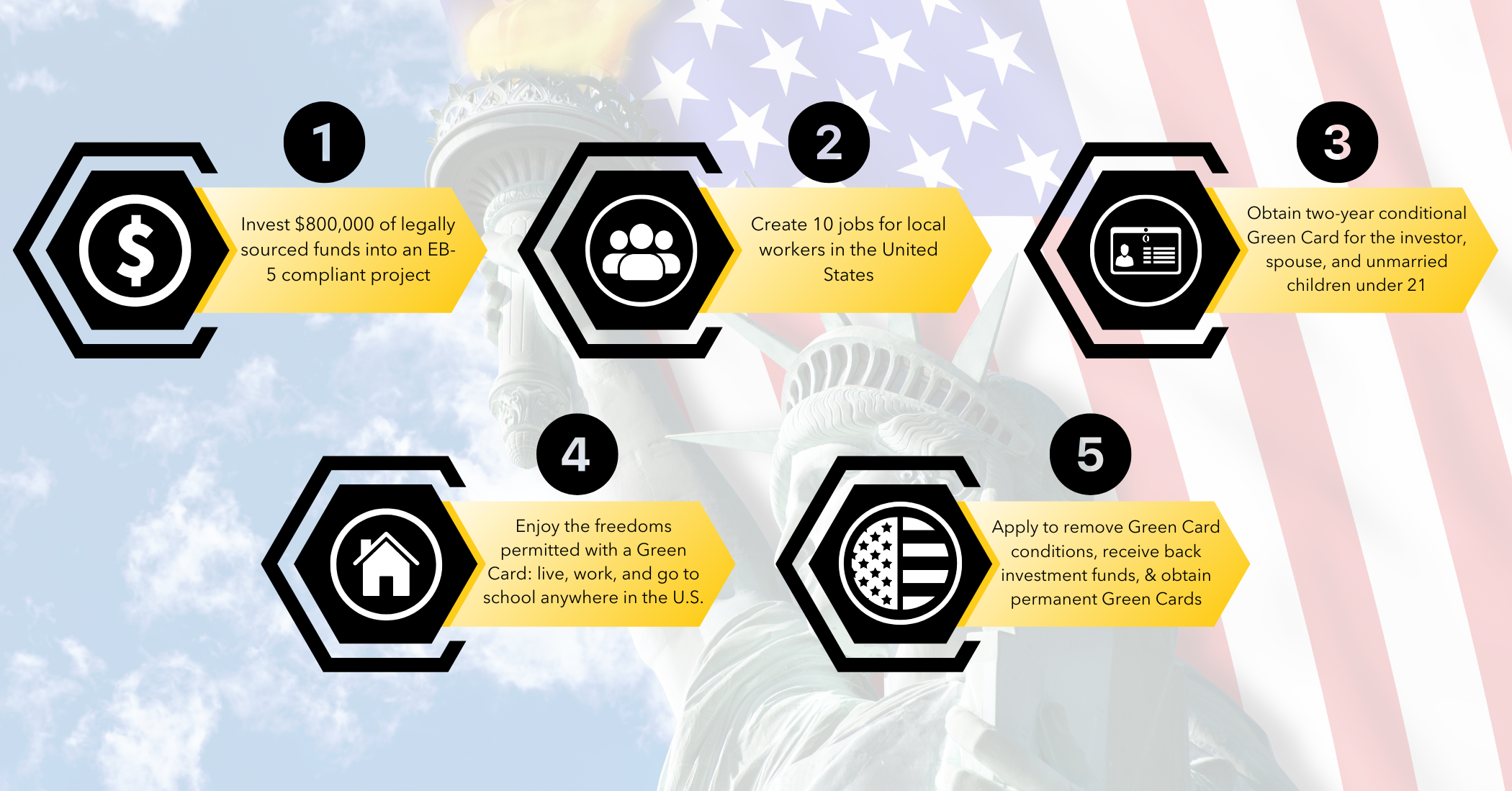

Financial investment migration has gotten on an upward trend for greater than 20 years. The Immigrant Financier Program, additionally known as the EB-5 Visa Program, was established by the U.S. Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its key function: to boost the U.S. economic situation through job creation and capital financial investment by here foreign capitalists.

This consisted of reducing the minimal financial investment from $1 million to $500,000. Over time, modifications have actually increased the minimal financial investment to $800,000 in TEAs and $1.05 million in various other locations.

The Best Guide To Eb5 Immigrant Investor Program

Programmers in rural areas, high joblessness areas, and framework tasks can profit from a dedicated pool of visas. Capitalists targeting these details locations have actually a boosted likelihood of visa schedule.

Developers servicing public jobs projects can currently get approved for EB-5 financing. Financiers currently have the chance to buy government-backed infrastructure projects. Specific USCIS interpretations under previous regulation are secured by law, including forbidden redemption and financial debt plans, and talented and loaned mutual fund. Developers require to guarantee their investment arrangements abide with the new statutory interpretations that influence them under united state

migration legislation. EB5 Immigrant Investor Program. Financiers must recognize the approved sorts of mutual fund and arrangements. The RIA has actually established needs for concerns such as redeployment, unlike prior to in previous versions of the regulation. Capitalists and their family members already lawfully in the U.S. and qualified for a visa number might simultaneously submit applications for modification of standing in addition to or while awaiting adjudication of the financier's I-526 request.

This streamlines the process for investors currently in the U.S., quickening their capability to readjust condition and avoiding consular visa processing. Rural jobs obtain priority in USCIS processing. This urges programmers to initiate projects in country areas as a result of the much faster handling times. Investors looking for click here a quicker processing time may be a lot more likely to buy rural tasks.

Excitement About Eb5 Immigrant Investor Program

Seeking united state government info and services?

The EB-5 program is an opportunity to create tasks and promote the U.S. economic situation. To certify, applicants need to buy new or at-risk industrial ventures and produce full time placements for 10 certifying staff members. The U.S. economy advantages most when a location goes to risk and the brand-new financier can supply a functioning establishment with full time jobs.

TEAs were executed into the investor visa program to encourage buying places with the best demand. TEAs can be backwoods or locations that experience high joblessness. A backwoods is: outside of basic city statistical areas (MSA), which is a city and the surrounding locations within the external boundary of a city or community with a population of 20,000 or even more A high unemployment area: has actually experienced unemployment of at the very least 150% of the nationwide average price An EB-5 regional center can be a public or exclusive economic device that promotes financial development.

Report this page